New market data shows Regulation Crowdfunding hasn’t dried up. Investor capital is concentrating into fewer, larger deals, and the winners are clear. The market didn’t disappear. It narrowed. Regulation Crowdfunding activity has slowed in terms of new launches, but investor money is still moving. Aggregate data from industry trackers and federal disclosures shows hundreds of […]

The headline is one platform’s tally. The bigger story is whether this corner of private markets is starting to behave like a repeatable channel. DealMaker is opening 2026 with a recap meant to read like a market datapoint. In a year-end post, the firm said it processed $500 million in 2025, which it framed as […]

If the SEC seriously considers lifting the crowdfunding cap, it could change how early-stage companies structure rounds, and how individual investors access them. The next big inflection point for U.S. equity crowdfunding may not come from a flashy issuer campaign or a new platform feature. It may start the way many market rule changes start: […]

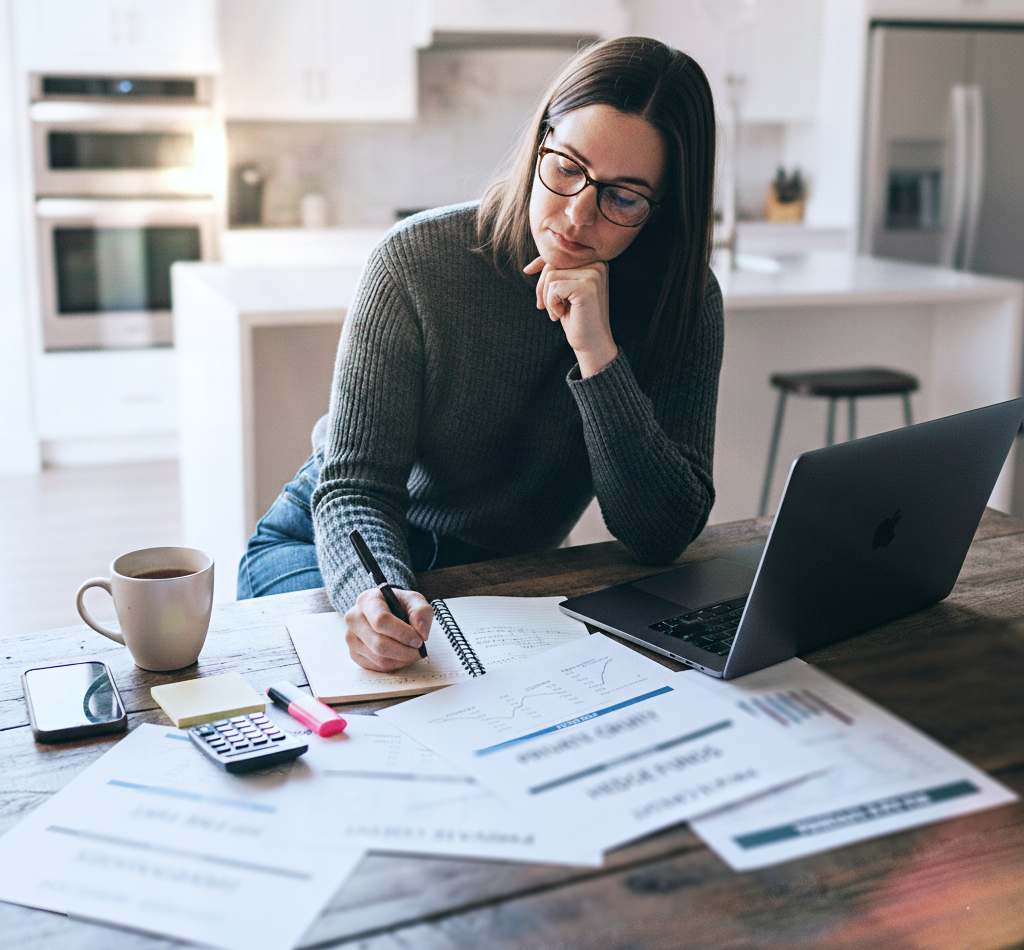

Alternatives are not a single “better” category. They are different tools, each with a specific way it earns returns and a specific way it can hurt you. If you’ve built wealth mostly through public stocks and bonds, alternatives can feel like a locked door with a lot of confident people on the other side. The […]

Returns usually come from a small set of repeatable engines, not the story around the company. Look for evidence of pricing power, improving unit economics, retention and expansion, and distribution efficiency, because those are the levers that turn growth into durable value. If you can’t point to which engine is doing the work and verify […]

Why Reg A+ offerings can turn “private-market patience” into a clearer, more trackable path for everyday investors. Reg A+ gets introduced as a bridge between private and public markets, but its simpler function is a way for growing companies to raise significant capital openly, with a disclosure package that investors can actually follow. That […]

In fast adoption cycles, the biggest loss is not missing the winner. It is missing the weeks when a new edge is still learnable. The easiest way to misunderstand a missed investment opportunity is to treat it like a single moment you failed to act. You did not buy. You sold too soon. You ignored […]

AI is not replacing dealmakers, but it is rewiring how targets are found, vetted, priced, and defended in 2025. The modern M&A process starts the same way it always has. Someone believes one company should buy another, and a small group of people works to support that idea. What sets today apart is how quickly […]

How internal tools moved from engineering afterthought to strategic leverage. The first sign that something had changed was not a new programming language or a popular open source library. It was a slide in a board meeting. Alongside revenue, margins, and churn, a fourth chart showed up: deployment frequency and DevEx score. The message was […]

How everyday professionals are using AI to create outsized opportunity A Shift Hiding in Plain Sight The first wave of internet millionaires consisted of people who saw the value of leverage before everyone else. They understood that software could grow faster than labor, and those who took action early gained the most. A similar situation […]

The real signals behind the coming wave of AI IPOs The Pressure Behind the Pipeline After nearly two years of private investment in artificial intelligence, public markets are starting to take notice. Investors are no longer just focused on model companies or chip makers. They are looking at the entire ecosystem: compute marketplaces, enterprise AI […]